Your business size and structure will determine which QuickBooks Online plan is best. If you’re a single freelancer, you won’t need to manage any other employees, and you won’t need to track many sales (if any) – so the Self-Employed Plan is best for you. We’ve ranked the best self-employed accounting software, and QuickBooks is at the top. But with the right accounting or invoicing software for small businesses, filing tax information can be a simple and streamlined process. QuickBooks makes this process even easier thanks to a huge range of integrations and plug-ins you can use, with familiar names such as PayPal, Shopify and MailChimp all present and accounted for.

Choose the QuickBooks Desktop or Online product for your needs

New users can choose between a 30-day free trial or a three-month 50% discount. If you choose the free trial, note that QuickBooks requires a credit card to sign up. Your card will be charged automatically once the trial ends unless you cancel in advance. At $30 https://www.simple-accounting.org/ per month, Intuit QuickBooks Online has one of the highest starting prices of any accounting software. But if you can afford QuickBooks’ cost, its excellent features will help you keep your finances in line as you grow from startup to fully fledged enterprise.

Compare QuickBooks products

You also have the option to import products and services into the application to avoid having to re-enter the data. We evaluated QuickBooks Online vs Desktop based on pricing, ease of use, customer support, and the availability of important features, like banking, project accounting, and inventory management. QuickBooks Online and Desktop share many similarities, including income and expense tracking, bank reconciliation, accounts payable (A/P) and accounts receivable (A/R) management, and reporting. We consider them tied in terms of features, as they are both robust accounting software, and they have their own strengths and weaknesses. Many satisfied QuickBooks Online users appreciate that they can access the program from any internet-enabled device.

Will my app still work with QuickBooks Desktop 2022?

One of the best alternatives to QuickBooks Desktop is QuickBooks Online, especially for accountants and bookkeepers. As we’ve pointed out, QuickBooks is the most popular accounting software, and its cloud-based subscription service offers helpful features at different plan levels. All the plans are extremely expensive compared to other options, though. Freelancers and solo-operated businesses need accounting software, but maybe not as robust as QuickBooks—that’s where FreshBooks makes sense. It’s designed for single users to send and manage invoices for a handful of clients. You aren’t limited by the number of invoices you send on any plan, but lower-priced plans limit the clients you can bill and manage.

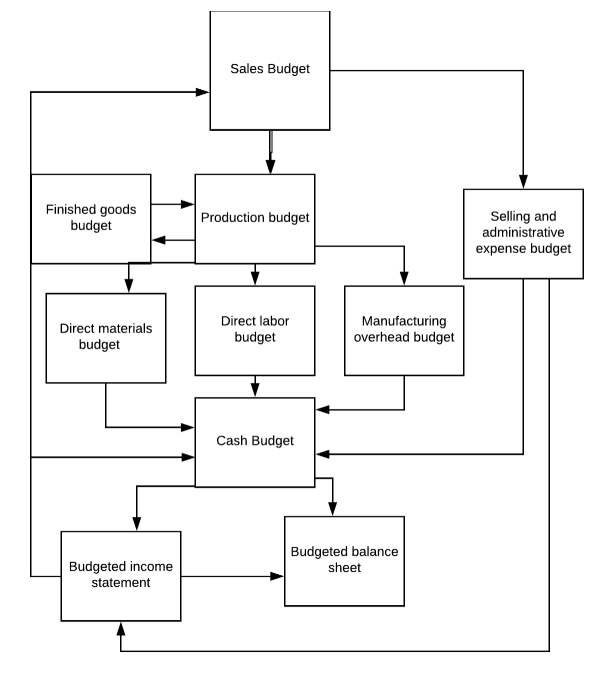

Larger businesses will be looking at QuickBooks Premier, QuickBooks Enterprise, or the new QuickBooks Online Advanced plan, depending on the number of users they need. Both are locally-installed accounting solutions, both offer numerous features and robust reporting, and both have numerous integrations. If you can’t decide between two programs, here’s how they stack up head-to-head to help you determine which version of QuickBooks is the best accounting solution for your business. This table takes a deep look into each program’s features, so you’ll know exactly what each version of QuickBooks is capable of. Comparing QuickBooks features is one of the best ways to decide which version of the software is the best fit for your business.

The type of business you run has a huge influence on which QuickBooks product is right for you. If you’re running a small business, you’ll be comparing QuickBooks Online or QuickBooks Pro. The first major deciding factor is whether or not you want cloud-based or locally-installed software. Best for small to medium-sized businesses looking for locally-installed software compatible with Macs.

QuickBooks Payroll starts at $45 a month plus $6 per employee paid per month, and new users can choose between a 30-day free trial or 50% off discount just as they can with QuickBooks Online. While QuickBooks Self-Employed is a passable income-tracking and invoicing app for the self-employed, it’s pricier than other freelance-friendly accounting accelerated depreciation for business tax savings tools like Wave Accounting and Xero. If you aren’t currently a QuickBooks Desktop customer, you’ll have to decide quickly if you want to use this accounting software. After July 31, 2024, new subscriptions will no longer be sold in the US for QuickBooks Pro, QuickBooks Premier, QuickBooks Mac, and QuickBooks Enhanced Payroll.

For one thing, it limits the number of invoices its customers can send each month to 20 with the cheapest plan. The lowest-tier plan users are also limited to managing just five bills a month and creating 20 estimates a month. QuickBooks Online syncs with more than 750 different third-party business apps, ranging from point-of-sale apps to payment acceptance tools and beyond. Naturally, QuickBooks Online syncs with other QuickBooks products as well, including QuickBooks Time (formerly TimeTrex), TurboTax and QuickBooks Online Payroll.

- The QuickBooks software offers dropdown menus for easy access to its many tools.

- Whatever the case, the right integration will make your business operations even more streamlined.

- If you want QuickBooks to file your taxes for you, then you must upgrade to QuickBooks Desktop Assisted Payroll for $109 per month plus $2 per employee.

- QuickBooks Online supports a variety of browsers including Google Chrome, Mozilla Firefox, Microsoft Edge, as well as Safari 11 or later for Mac.

- Users can also use it to create customized tags and reports that help you hone in on specific income and expense trends and up your business’s cash flow.

As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software. This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts (COA), vendors, customers, service items, and inventory items. Ideally, there will be a wizard to walk the user through the import process.

On the other hand, QuickBooks Enterprise is designed for larger businesses that want access to more users and more features without fully upgrading to ERP software. Best for small to medium-sized businesses with three https://www.accountingcoaching.online/how-accountants-handle-accounts-payable-and/ users or fewer looking for strong accounting or locally-installed software. Quickbooks Self-Employed has very limited integrations, but the Turbo Tax integration is one of the greatest parts of the software.

Others mentioned the bank account reconciliation and invoicing features are excellent. QuickBooks Online is on par with Desktop in terms of banking, but we believe that the cloud-based version is better for professional invoicing. The dashboard is super intuitive with large, easy-to-understand charts, and the mobile app is similarly easy to use.

While you can add cloud access to QuickBooks Enterprise, it involves an additional fee. You can send a copy of your company file to your accountant and import their changes. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. We believe everyone should be able to make financial decisions with confidence. 2.Based on lab testing vs. prior QuickBooks Desktop (32-bit) versions using a 1GB average file size.

In both QuickBooks Online and Desktop, you can assign costs to your inventory items and track the quantities sold to calculate the cost of goods sold (COGS). QuickBooks Online wins because it offers more professional-looking and customizable invoices than QuickBooks Desktop. Also, it allows you to calculate sales taxes automatically to apply to an invoice based on the customer’s address. This feature is particularly useful if you sell and ship products out of your state. Speaking of extra fees, QuickBooks Desktop also charges for e-commerce app integration, invoice-based payment acceptance, and online data hosting. If you choose QuickBooks Desktop Pro Plus, you’ll also need to pay extra if you want to access customer service via live chat.

What stands out most about QuickBooks Online when compared to Desktop is that QBO is cloud-based accounting software. Because of this, QuickBooks Online is much easier to use and has many more integrations and time-saving invoicing automations, such as auto-scheduling. While we’re on the topic of invoicing, QuickBooks Online has the superior product, offering six invoice templates and multilingual invoicing in six languages.